28+ Mortgage calculator per year

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. For example you could make biweekly payments or one extra lump sum payment per year.

Mailing List Templates 12 Free Docs Xlsx Pdf Formats Mailing List Template List Template Templates

The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment.

. If a person. VA mortgage calculator. 30-Year Mortgage You can get a mortgage for nearly any termthat is any timeframebut the two most common are 15-year and 30-year periods.

Mortgage Calculator FAQ. If you take out a 30-year fixed rate mortgage this means. At 6 fixed interest that amount rises to 1986.

Getting ready to buy a home. The Texas Mortgage Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax credit based on mortgage interest paid in the tax year. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

While you may have heard of using the 2836 rule to calculate affordability. Per month per year one time Biweekly repayment Normal repayment. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

N 30 years x 12 months per year or 360 payments. Home financial. 15-Year Mortgage Vs.

PMI is 05-1 of the loan amount per year PMI is canceled once your mortgage balance reaches 78. Number of Regular Payments. TD for example allows you to skip the equivalent of one monthly mortgage payment once per year.

Estimate your monthly mortgage payment with our easy-to-use mortgage calculator. Todays mortgage rates in Texas are 6171 for a 30-year fixed 5217 for a 15-year fixed and 5265 for a 5-year adjustable-rate mortgage ARM. We used the calculator on top the determine the results.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Well find you. People typically move homes or refinance about every 5 to 7 years.

Payoff in 14 years and 4 months. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Applicants must be first-time homebuyers and must meet income and purchase price limits.

Build home equity much faster. 10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options.

30-Year Fixed Mortgage Principal Loan Amount. Almost any data field on this form may be calculated. NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA.

This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. While the maximum affordable mortgage. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Historical 30-YR Mortgage Rates. Department of Housing and Urban Development HUD. Payments towards your loan principal.

The following table lists historical average annual mortgage rates for conforming 30-year mortgages. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. A mortgage of 300000 will cost you 1620 per month in interest and principal for a 30-year loan and a fixed 4 interest rate.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. To calculate this multiply your monthly income by 28 or 36 and then divide it by 100. These skip-a-payment options dont mean that youre off the hook for the payment amount.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. You can check your budget using a mortgage affordability. Our simple mortgage calculator with taxes and insurance makes it easy to calculate your mortgage payment without the headache of performing the tedious math yourselfor worse guesstimating what the payments might be.

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page.

Free Personal Business Financial Plan Templates Excel Best Collections

Total Debt Service Ratio Explanation And Examples With Excel Template

Pin On Next House

Pin On T I P S I D E A S

Sales Forecast Templates 15 Free Ms Docs Xlsx Pdf Excel Templates Templates Invoice Template

Payslip Templates 28 Free Printable Excel Word Formats Business Template Templates Professional Templates

Http Www Home Designing Com Wp Content Uploads 2013 02 Subtle Art Deco Inspired Living Mon Art Deco Living Room Art Deco Home Types Of Interior Design Styles

6 Wainscoting Wainscoting Styles Pictures For Kitchen Walls Kitchen Design Diy

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Word Template

Illinois Appraisal Continuing Education License Renewal Mckissock Learning

Office Relocation Project Plan Template Lovely 13 Moving Inventory Templates Free Sample Exa Business Plan Template Simple Business Plan Template How To Plan

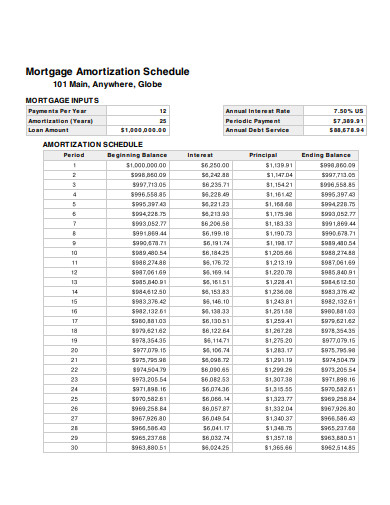

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Kitchens Ron Davis Custom Homes Kitchen Remodel Kitchen Custom Homes

Payslip Templates 28 Free Printable Excel Word Formats Templates Cover Letter Format Excel

4 Tier Ladder Bookshelf Storage Display With 2 Drawers Ladder Bookshelf Bookshelf Storage Bookcase Storage

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Excel Spreadsheets Templates Downloadable Resume Template Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Repayment